Happy New Year! Following up on my last two posts that dealt with individual ERISA breach of fiduciary duty claims, this morning’s post deals with the dismissal of a potential breach of fiduciary duty class action. On December 30, 2016, the U.S. Court of Appeals for the District of Columbia Circuit affirmed the dismissal of a “stock drop” lawsuit filed by a former employee of J.C. Penney. See Coburn v. Evercore Trust Co., N.A., No. 16-7029, 2016 U.S. App. LEXIS 23396 (D.C. Cir. December 30, 2016). A copy of the opinion is available here.

Oops! We could not locate your form.

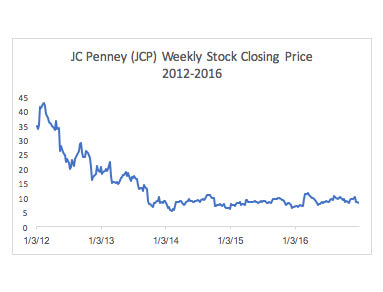

The appellant was a former J.C. Penney employee and investor in a J.C. Penney employee stock ownership plan (“ESOP”) managed by Evercore Trust, who was a plan fiduciary. She claimed that Evercore breached its fiduciary duties of prudence and loyalty when it failed to take preventative action as the value of J.C. Penney stock fell significantly between 2012 and 2013, thereby causing significant losses to the ESOP.

While Coburn was employed by J.C. Penney, the company sponsored the J.C. Penney Savings Profit-Sharing and Stock Ownership Plan (the Plan), which is a defined contribution retirement plan governed by ERISA. Once an employee opted into the Plan, the employee could allocate his or her contribution among a variety of investment options, including the Penney Stock Fund, an ESOP that consisted largely of J.C. Penney common stock. Evercore had the authority to restrict or limit the ability of Plan participants to purchase or hold J.C. Penney stock, including the power to remove the Penney Stock Fund as an investment option under the Plan and to sell or dispose of J.C. Penney stock contained in it.

From the end of 2012’s first quarter to the end of 2013’s fourth quarter, the company’s stock price fell from $36.72 to $5.92 per share. While the stock price fell, Evercore did not sell the company stock in the Penney Stock Fund or eliminate it as an investment option. Consequently, the appellant sued on behalf of herself and all others similarly situated, alleging that Evercore was liable for $300 million in losses to the Plan for having breached its fiduciary duty under section 409 of ERISA, 29 U.S.C. § 1109.

The district court granted Evercore’s motion to dismiss the complaint for failure to state a claim, relying on the United States Supreme Court’s opinion in Fifth Third Bancorp v. Dudenhoeffer, 134 S. Ct. 2459 (2014). The district court held that the allegations that Evercore should have recognized from publicly available information that continuing to invest in company stock was “imprudent” were generally implausible absent “special circumstances” affecting the market, which the Appellant did not plead and disclaimed any need to plead.

The Circuit court explained that in Dudenhoeffer, the Supreme Court refined the pleading requirements regarding claims that a fiduciary should have recognized from public information alone that a stock was over or under valued. See Dudenhoeffer, 134 S. Ct. at 2471. There, the Supreme Court held that “where a stock is publicly traded, allegations that a fiduciary should have recognized from publicly available information alone that the market was over-or undervaluing the stock are implausible as a general rule, at least in the absence of special circumstances.” Id. at 2471. As the D.C. Circuit noted: “Dudenhoeffer was thus grounded in the efficient capital market theory – the ‘theory that security prices reflect all available information.’” (citations omitted). Dudenhoeffer, therefore, requires plaintiffs to allege specific “special circumstances” when bringing a breach of fiduciary duty claim against a fiduciary in some stock drop cases.

The D.C. Circuit held the appellant’s claim did not satisfy the pleading requirements set forth in Dudenhoeffer because she did not make any allegations of special circumstances such as that the stock was trading in an inefficient market. Although the appellant attempted to distinguish Dudenhoeffer, the D.C. Circuit rejected that argument and noted that the plaintiffs in Dudenhoeffer made similar arguments that were rejected there as well. Instead, it followed precedent established by the Second, and Sixth Circuits and affirmed the dismissal of her case.

For those who are interested in reading more on this topic, the Supreme Court’s Dudenhoeffer opinion can be downloaded here.